Corporate Governance

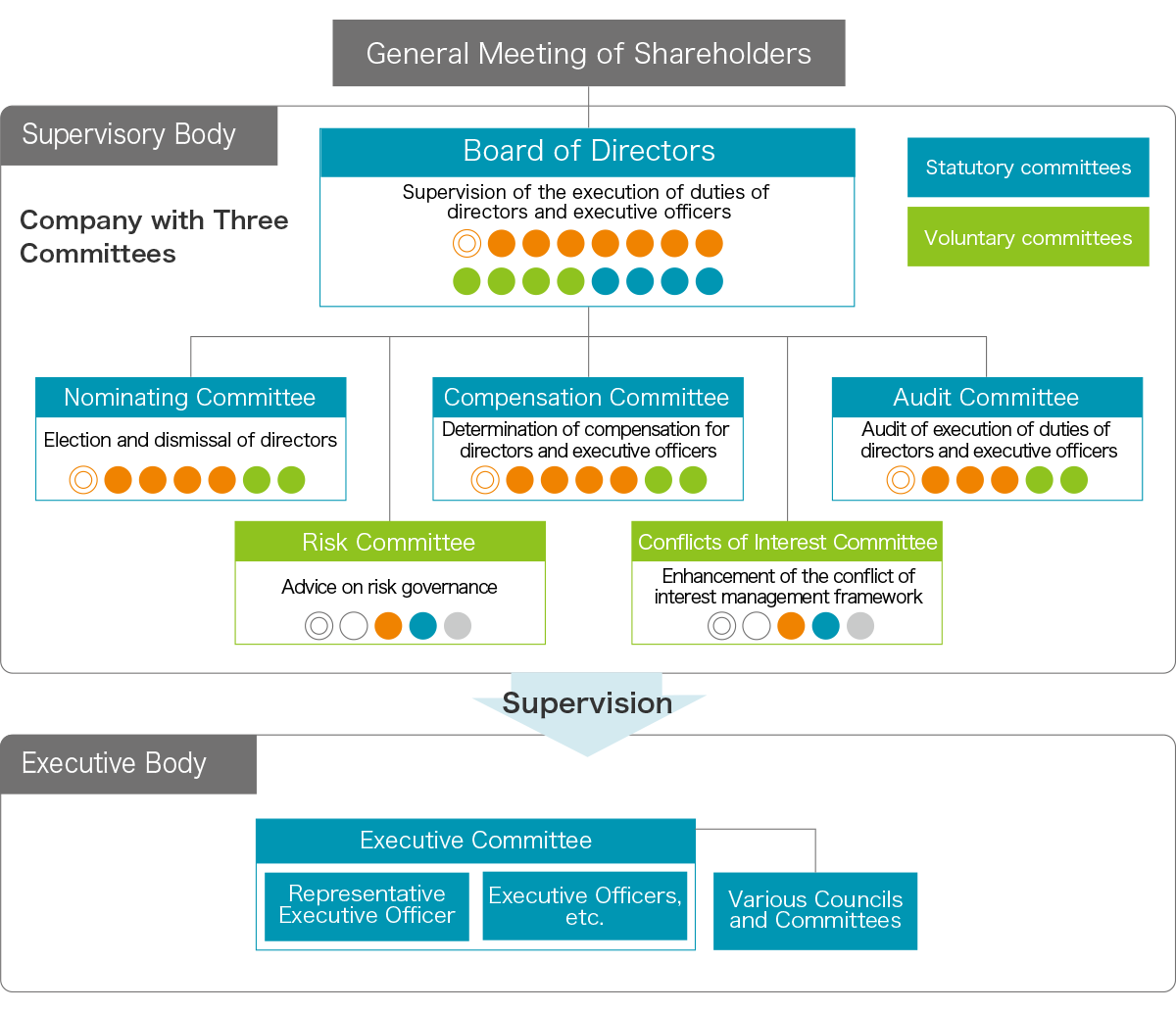

SuMi TRUST Group is enhancing its corporate governance structure in line with its business model. In addition to the statutory committees of a company with Three Committees, we have also established a Risk Committee and Conflict of Interest Committee, both of which function as advisory bodies to the Board of Directors. We also strive to enhance management transparency by appointing an external director as Chairperson of the Board of Directors.

Basic Initiative Policy

In order to implement sound management based on a high degree of self-discipline guided by our fiduciary spirit and to gain the unwavering trust of society, we are committed to enhancing corporate governance along the lines of the following basic philosophy with the objective of improving the Group’s sustainable growth and medium- to long-term corporate value.

Having defined the SuMi TRUST Group’s Reason for Existence (“Purpose”) and identified its high-priority management issues (“Materiality”), such as Japan’s declining birthrate and aging population, climate change, and digitalization, SuMi TRUST Group also recognizes that taking on the mission of solving social issues presents the SuMi TRUST Group with growth opportunities, which is why the Company shall place at the core of its management approach the notion of “balanced creation of both social and economic value.”

As the foundation for every activity to be shared by all the officers and employees of the SuMi TRUST Group, the Board of Directors shall establish management principles (“Mission”), an ideal model (“Vision”), and codes of conduct (“Value”).

Basic Philosophy

- SuMi TRUST Group shall respect shareholder rights, and endeavor to develop an environment in which shareholders can exercise their rights appropriately and effectively, and to secure the effective equal treatment of shareholders;

- By recognizing the importance of its social responsibilities and public mission, SuMi TRUST Group shall endeavor to appropriately cooperate with its stakeholders, including shareholders, clients, employees, business partners, and local communities (hereinafter referred to as “Stakeholders”), and to develop a corporate culture and climate in which it conducts sound business operations based on a high degree of self-discipline;

- In order to establish a basis for constructive dialogue with its Stakeholders, SuMi TRUST Group shall separately set out its Disclosure Policy, and endeavor to appropriately disclose corporate information, including non-financial information, and ensure the transparency of its corporate management.

- As the financial holding company that assumes the corporate management function of the SuMi TRUST Group, SuMi TRUST Group shall adopt the institutional design of the Company with a Nominating Committee, etc. and, by separating the execution and monitoring of business, shall endeavor to ensure the Board of Directors’ role of effective monitoring; and

- SuMi TRUST Group shall engage in constructive dialogue with its Stakeholders in order to contribute to sustainable growth, as well as the medium- to long-term enhancement of the corporate value of SuMi TRUST Group.

Basic Policy on Corporate Governance

Corporate Governance Report

Our Views on Corporate Governance

SuMi TRUST Group is a financial holding company with many subsidiaries under its Group umbrella, including SuMi TRUST Bank, Sumitomo Mitsui Trust Asset Management, and Amova Asset Management. Guided by our fiduciary spirit, we aim to leverage our significant expertise and creativity to combine our banking, asset management & administration, and real estate businesses to deliver total solutions to our clients as their "Best Partner." In order to fulfill our principles and live up to the expectations of our stakeholders, we make every effort to ensure the soundness and reliability of the Group's business model, as well as management transparency, and continually strive to enhance the Group's corporate governance.

Corporate Governance System

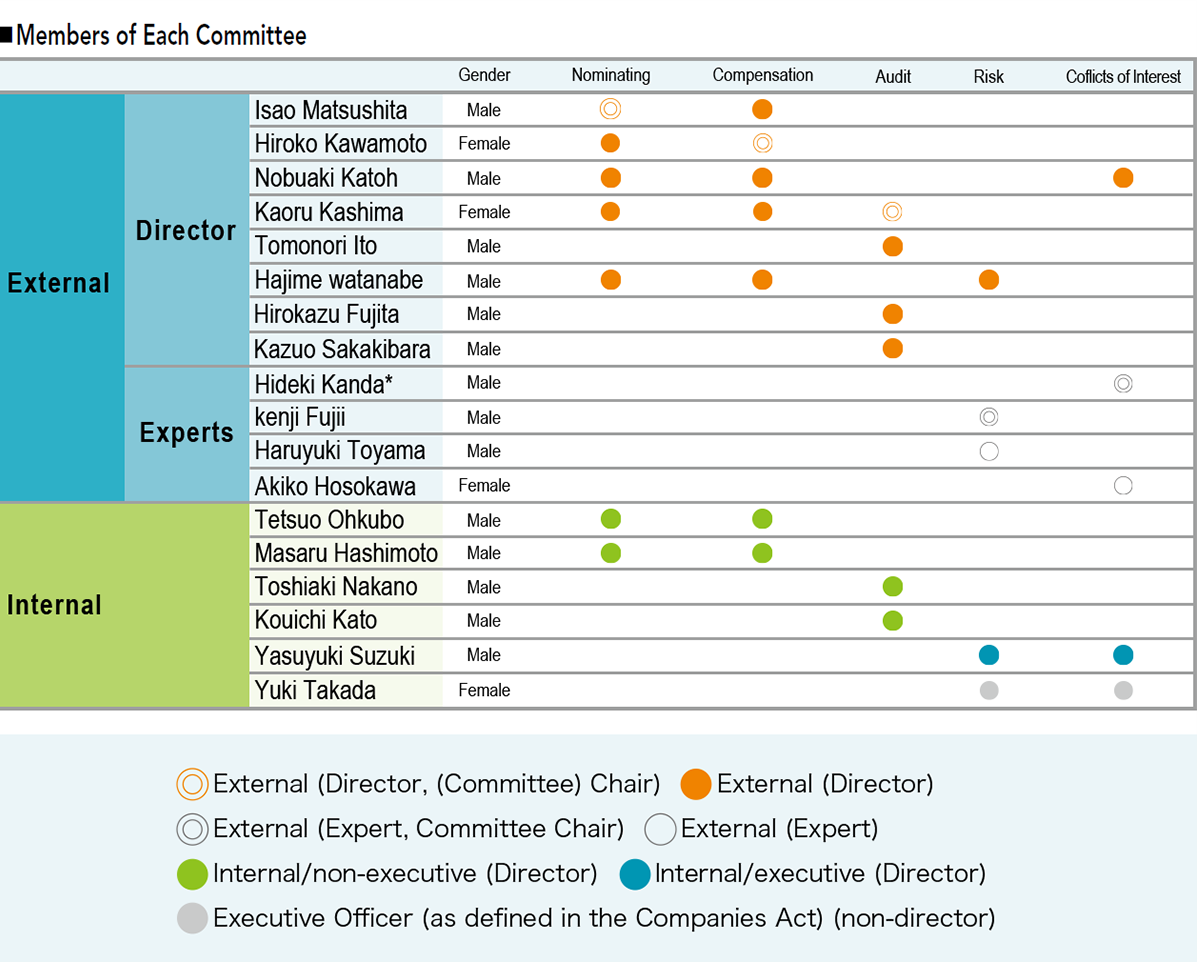

* Mr. Hideki Kanda is an external director of SuMi TRUST Bank.

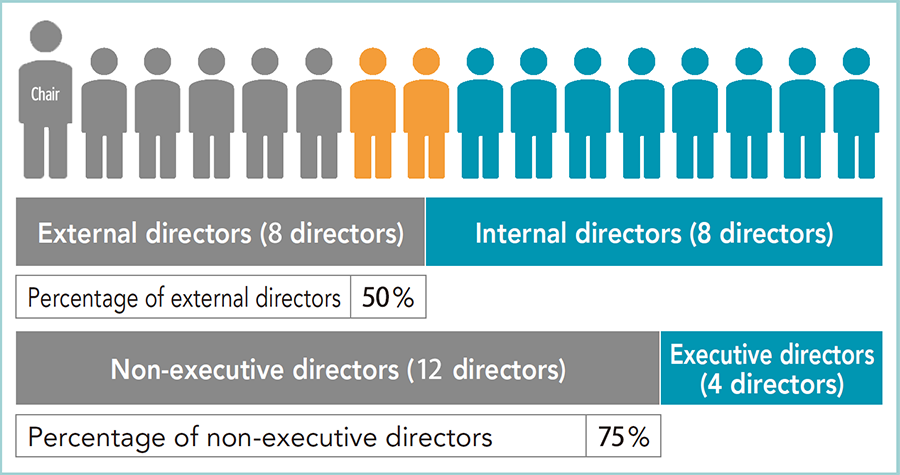

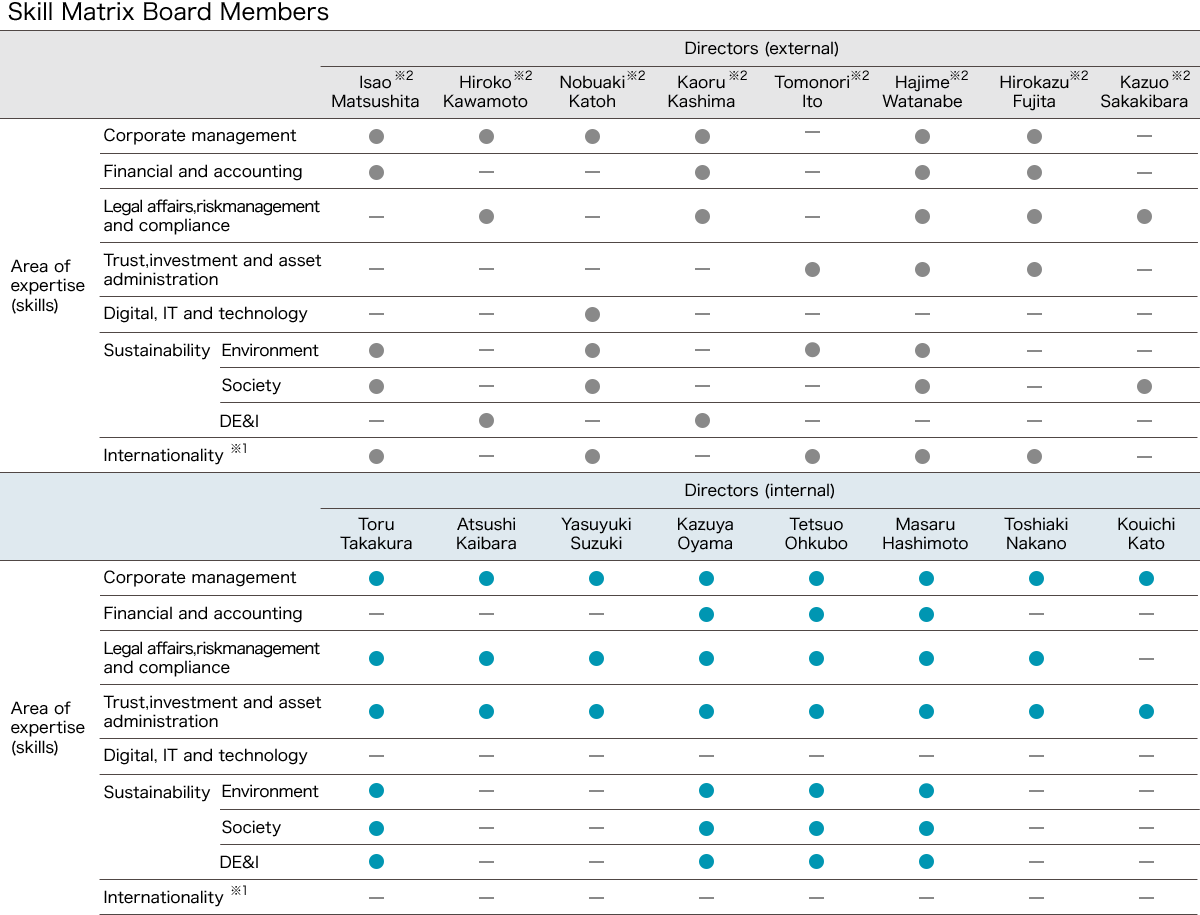

Independence of Directors

SuMi TRUST Group has established nomination policies of external directors in the Basic Policy on Corporate Governance. External directors are decided from among those who can address SuMi TRUST Group’s high-priority management issues (Materiality) with deep insight and extensive experience in corporate management, finance and accounting, the areas of legal, risk management, and compliance, the areas of trust, asset management, and asset administration, digital technology/IT, internationality, or in the areas of sustainability, including knowledge and experience about social issues, environment, and DE&I. They shall also exhibit the following qualities: (i) A person who satisfies the Independence Standards of SuMi TRUST Group, and who is deemed unlikely to give rise to conflicts of interest with general shareholders of SuMi TRUST Group; (ii) A person who fully understands SuMi TRUST Group’s management principles and its social responsibilities and roles as a trust bank group, and who can monitor the management of SuMi TRUST Group and give accurate and appropriate opinions and advice. Furthermore, these eight external directors were appointed as independent officers as they satisfied the Independence Standards

.

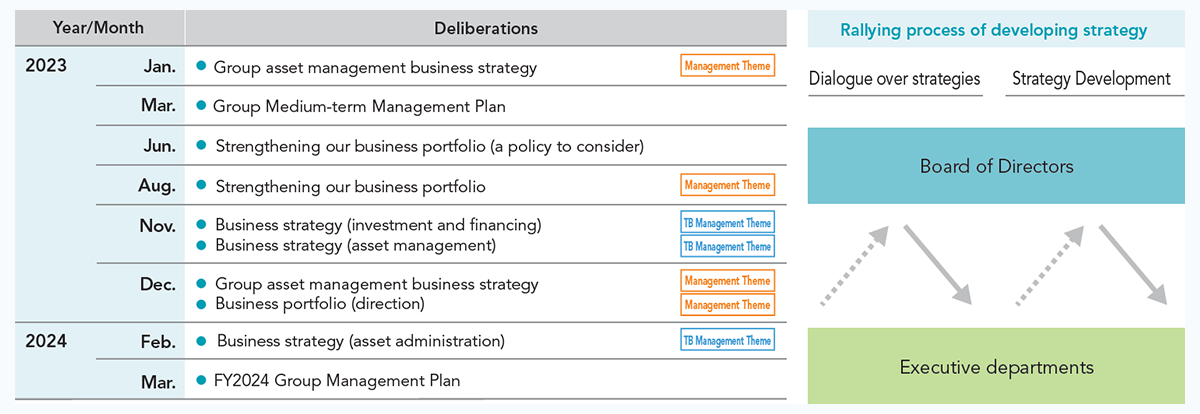

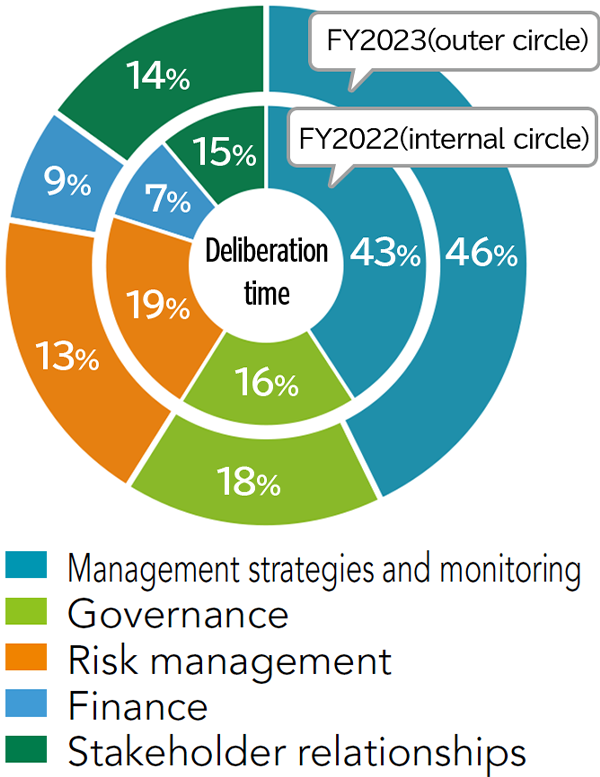

Board of Directors

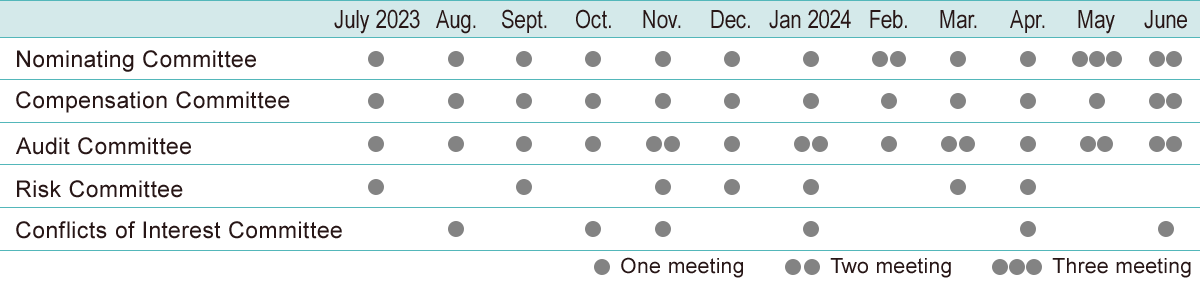

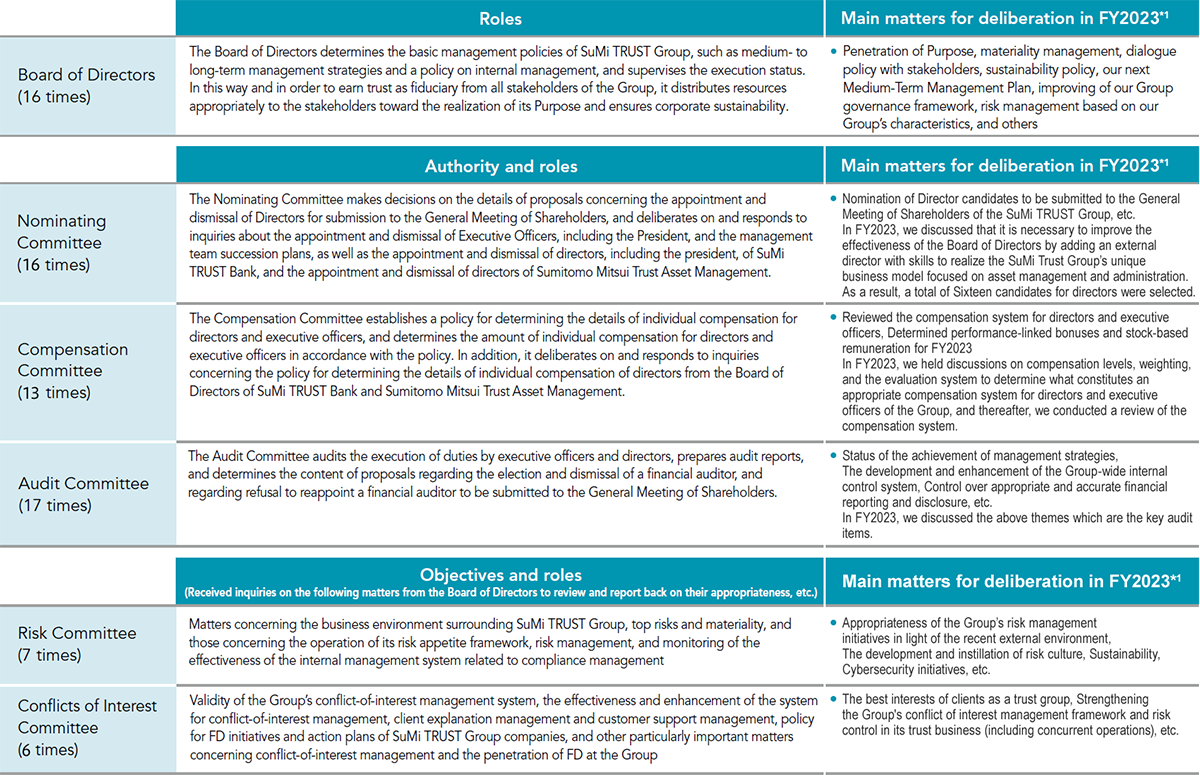

Committees

To ensure the effectiveness of corporate governance and further enhance the soundness and reliability of the Group’s business model, as well as the transparency of management, we have established the Risk Committee and the Conflict of Interest Committee as advisory bodies to the Board of Directors to complement the three committees required under the Companies Act, namely, the Nominating Committee, the Compensation Committee, and the Audit Committee.

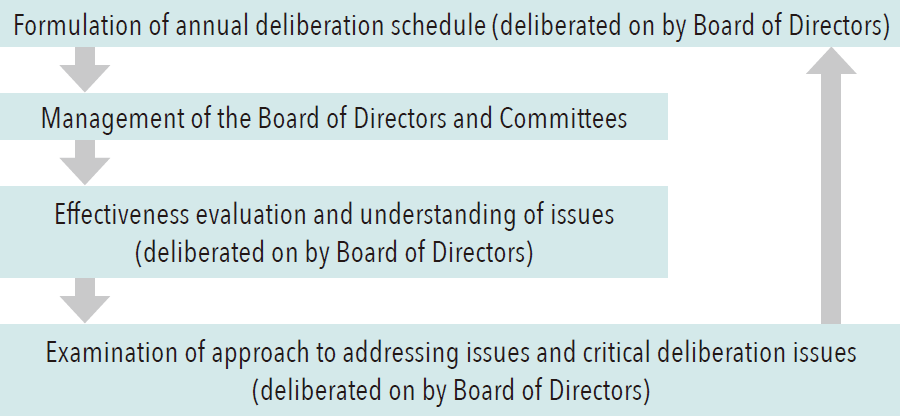

Every year, each committee conducts a self-evaluation in an effort to improve its autonomous management by considering and adopting measures aimed at improving issues identified in the evaluation. The results of the self-evaluations are reported to the Board of Directors in April for deliberation.

Succession Plans

In order to achieve sustainable growth for the Group and enhance its corporate value, we have formulated succession plans for the top management of SuMi TRUST Group, SuMi TRUST Bank and Sumitomo Mitsui Trust Asset Management. We have also created management personnel development plans for those in charge of managing each business and those engaged in corporate management. We have defined the ideal qualities and requirements for the nominees required to serve as directors and officers, and systematically manage and cultivate a group of candidates.

Development of Management Personnel Based on Management Team Succession Plan

Training and appointment process

The Nominating Committee selects a pool of top management candidates each year based on the proposals and opinions presented by the executive side. Based on the current and future business environment, the Nominating Committee deliberates on future development policies, assignments to be given to the candidates and other matters based on performance, achievements, evaluations, expertise and experience (skills), and reflects such matters as placement in different departments from the next fiscal year onward, giving candidates an opportunity to develop and to overcome challenges. We also continue to track the status of development. While continuing this cycle, when the Company actually appoints new top management members, the Nominating Committee will deliberate on the candidates’ performance, achievements, evaluations, expertise and experience (skills), in a multifaceted manner, with a focus on candidates who have been trained during the cycle, and will ultimately report to the Board of Directors. The progress of succession plans and development plans are periodically reported to the Board of Directors.

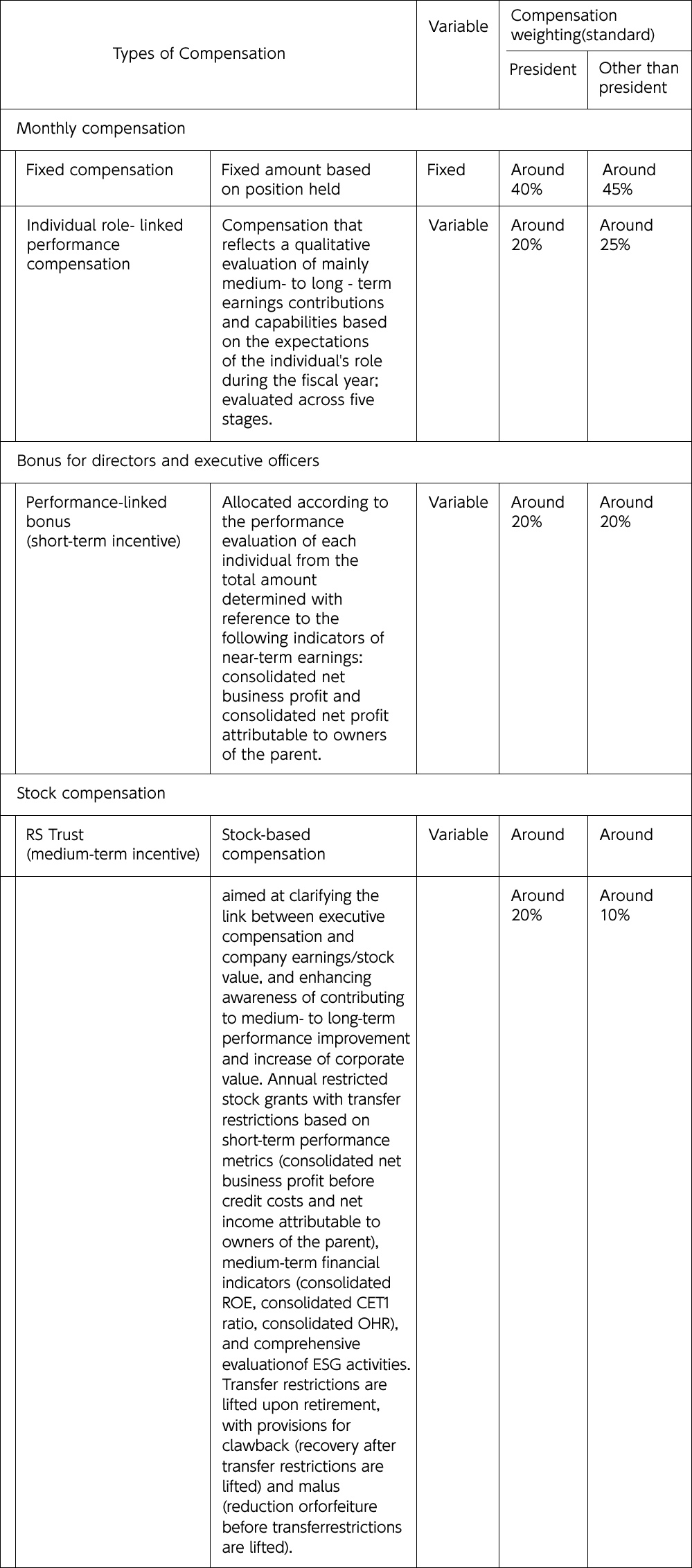

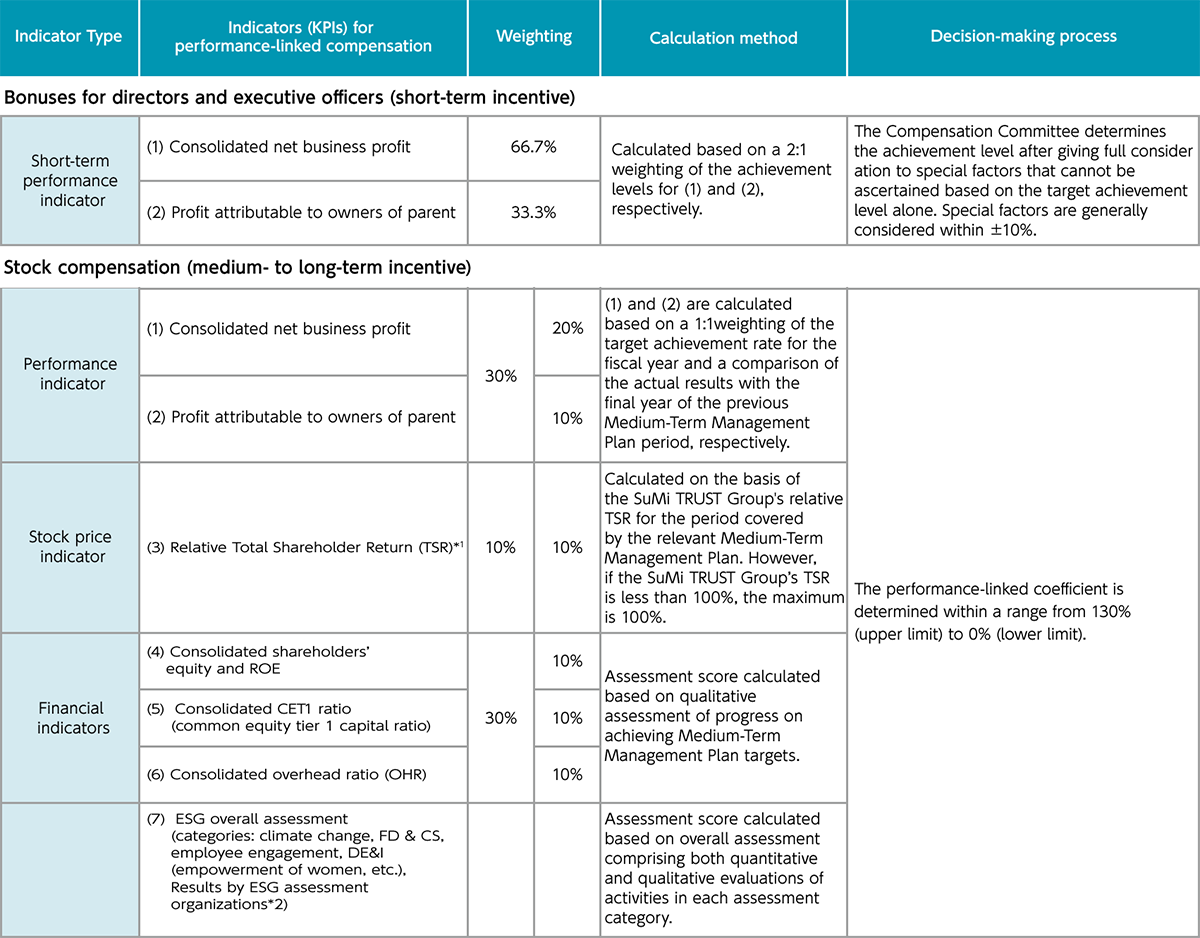

Compensation System for Directors and Executive Officers

External Directors' Meetings

The External Directors’ Meeting is a meeting body intended to foster trust among external directors through frank exchange of opinions and shared recognition from an independent and objective standpoint and to utilize the opinions expressed at the meeting to fulfil their roles as external directors by channeling them to the executive level as necessary. Two meetings were held during FY2024 and the following themes were discussed:

- Future vision of the Board of Directors to serve as a monitoring board composed of a majority of External Directors, and the composition of the Board of Directors to achieve the goals

- Subjects that should be deliberated by the Board of Directors

*Voluntarily meetings organized by external directors.

Strategic Shareholdings

SuMi TRUST Group has recognized strategic shareholdings as a material management issue and we have hedged the price volatility risk that exceeded our financial risk absorption buffer while constantly working to reduce the overall exposure obtaining the consent of our corporate clients.

SuMi TRUST Group has defined “creating a virtuous circle from increased enterprise value leading to increase in household savings, assets and capital,” as one of our goals. We shall endeavor to foster a virtuous circle framework that facilitates circulation of funds, assets and capital through our asset management and asset administration services, and enhancement of our corporate clients’ enterprise value by offering solution services, with the aim to develop Japanese capital markets.

To realize this objective, we intend to improve our bi-functional expertise as a trust bank Group that assumes the position of an investor as well as an advisor offering solutions to enhance enterprise value, and re-align our policy so that, in principle, we shall not hold any “strategic shareholdings as a conventional stable shareholder.” During the interim policy transition period, we shall strive to fulfill our role as an advisor that “offers solutions to issues to enable sustainable increase in enterprise value through extensive dialogue with our clients.”

- Pace of our strategic shareholding reduction target

Market value vs consolidated total net assets: Aim to achieve less than 20% by the end of March 2029 (including deemed shares)

Cost basis: 4 year (FY25-FY28) reduction target of cumulative total of ¥260bn - Policy regarding the exercise of voting rights regarding our strategic shareholdings

During the interim period in which we will continue to hold strategic shareholdings, SuMi TRUST Bank established the voting rights guidelines for strategic shareholdingsand disclosed the results of the exercise.

Targets for the Reduction of strategic shareholdings

- *1:Including repurchased shares and some shares other than strategic shareholding as a conventional stable shareholder

- *2:Including deemed shares and unlisted shares

B/S amount of investment securities held for purposes other than pure investment (Sumitomo Mitsui Trust Bank, Limited)

(Yen bn)

| Mar. 25 | Mar. 24 | |

|---|---|---|

| Listed shares | 887.2 | 1,211.3 |

| Unlisted shares | 88.8 | 87.0 |

| Deemed shares | 314.9 | 402.5 |

*:The amount of the deemed shares is the market value

Strategic shareholdings (Top 10)

Specified investment shares

| Mar. 25 | Mar. 24 | ||||

|---|---|---|---|---|---|

| Number of shares | B/S amount (Yen bn) | Number of shares | B/S amount (Yen bn) | ||

| 1 | SUZUKI MOTOR CORPORATION | 22,000,000 | 39.8 | 22,000,000 | 38.2 |

| 2 | NIDEC CORPORATION* | 14,023,200 | 34.9 | 7,011,600 | 42.9 |

| 3 | MINEBEA MITSUMI Inc. | 15,413,900 | 33.5 | 15,413,900 | 45.4 |

| 4 | DAIKIN INDUSTRIES,LTD. | 1,899,200 | 30.6 | 1,899,200 | 39.1 |

| 5 | DAIWA HOUSE INDUSTRY CO.,LTD. | 6,150,000 | 30.3 | 6,900,000 | 31.2 |

| 6 | ORIENTAL LAND CO.,LTD. | 9,569,300 | 28.1 | 11,258,000 | 54.5 |

| 7 | TOKYU CORPORATION | 15,677,000 | 26.4 | 20,312,200 | 37.4 |

| 8 | ITOCHU Corporation | 3,300,000 | 22.7 | 3,300,000 | 21.3 |

| 9 | Sumitomo Realty & Development Co.,Ltd. | 3,840,000 | 21.4 | 4,800,000 | 27.8 |

| 10 | MITSUI & CO.,LTD.* | 6,572,800 | 18.4 | 3,286,400 | 23.3 |

*:The increase in the number of shares is due to a stock split.

The deemed shares

| Mar. 25 | Mar. 24 | ||||

|---|---|---|---|---|---|

| Number of shares | Market Value (Yen bn) | Number of shares | Market Value (Yen bn) | ||

| 1 | Fujikura Ltd. | 6,777,000 | 36.5 | 6,777,000 | 15.4 |

| 2 | KUBOTA CORPORATION | 15,746,100 | 28.8 | 17,872,000 | 42.6 |

| 3 | Central Japan Railway Company | 10,025,000 | 28.6 | 10,025,000 | 37.3 |

| 4 | AEON CO.,LTD. | 6,370,000 | 23.8 | 6,370,000 | 22.9 |

| 5 | Nitori Holdings Co.,Ltd. | 1,440,000 | 21.3 | 1,440,000 | 33.9 |

| 6 | NIPPON STEEL CORPORATION | 6,438,300 | 20.5 | 6,438,300 | 23.6 |

| 7 | YASKAWA Electric Corporation | 5,208,000 | 19.4 | 7,439,900 | 47.1 |

| 8 | Mitsui O.S.K.Lines,Ltd. | 3,000,000 | 15.5 | 3,000,000 | 13.8 |

| 9 | Daiwa Securities Group Inc. | 12,444,000 | 12.3 | 12,444,000 | 14.3 |

| 10 | TOYOTA TSUSHO CORPORATION* | 4,584,000 | 11.4 | 1,828,000 | 18.7 |

*:The increase in the number of shares is due to a stock split.

Please refer to the company list below for the detail of strategic shareholdings.