The Equator Principles

Sumitomo Mitsui Trust Bank, Limited. (“SMTB”) became a signatory to the Equator Principles in February 2016. This set of guidelines for private financial institutions requires due consideration for the impact on the natural environment and regional communities when approving Project Finance.

The Equator Principles

The Equator Principles are standards that enable private-sector financial institutions approving loans for a large-scale project to confirm that the project pays sufficient care to impacts on the natural environment and regional communities. Regardless of the country where the project is sited or its industry, the Equator Principles are applied to Project Finance, Project-Related Corporate Loans (PRCL), and Bridge Loans that are intended to be re-financed by Project Finance or PRCLs.

The Equator Principles are based on guidelines and standards concerning environmental and social consideration, established by the International Finance Corporation, a member of the World Bank Group. These standards and guidelines span many fields from implementation processes of an Environmental and Social Impact Assessment (ESIA), pollution prevention, and consideration for regional communities to environmental protections.

June 2025, 129 Financial Institutions (including export credit agencies) from around the world have signed the Equator Principles. Signatories will require project proponents to comply with the Equator Principles. The signatories will not provide financing if requirements are not met, particularly in large-scale projects in developing countries, which usually require adequate consideration.

Types of Financial Instruments and Other Criteria Including Financing Size for the Application of the Equator Principles

| Type | Application criteria including the size of loans |

|---|---|

| Project Finance | Project Finance with total project capital costs of US$10 million or more. |

| FA services*1 | Same as the above |

| PRCLs*2 | PRCLs where all of the following three criteria are met:

|

| Bridge Loans | Bridge Loans with a loan term of less than two years that are intended to be refinanced by Project Finance or PRCL that is anticipated to meet the relevant criteria described above. |

| Project-Related Refinance and Project-Related Acquisition Finance | Project-Related Refinance and Project-Related Acquisition Finance where all of the following three criteria are met:

|

- *1Project Finance advisory services

- *2PRCL includes the buyer’s credit-type export financing but does not include the supplier’s credit-type export financing. Furthermore, it does not include asset financing, hedging transactions, leases, L/C transactions, general funds and general working capital to maintain operations of a company.

Operating Structure of the Equator Principles at Sumitomo Mitsui Trust Bank

Internal Operating Structure and Processes for Application of the Equator Principles

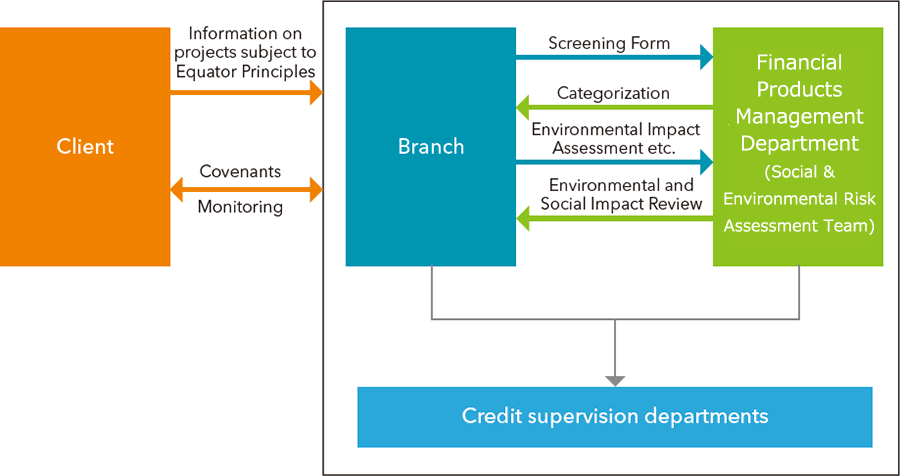

In adopting the Equator Principles, SMTB drew up rules for internal operation, which stipulated the policies on consideration for the environment and societies, and the assessment procedure for impacts on the environment and societies, based on the framework of the Equator Principles. Financial Products Management Department (Social & Environmental Risk Assessment Team) carries out assessments of environmental and social impacts relating to individual projects.

Reviewing Environmental and Social Impacts

According to the Equator Principles and “the Implementation Guidelines for the Equator Principles”, Financial Products Management Department (Social & Environmental Risk Assessment Team) reviews environmental and social impacts of projects subject to the Equator Principles to confirm whether consideration for the environment and communities the borrower has adopted for the project satisfies the standards established by the Equator Principles. In environmental and social impact reviews based on screening forms, each project is categorized into one of three categories - A, B, and C as shown below - reflecting its environmental and social risks. Financial Products Management Department (Social & Environmental Risk Assessment Team) conducts detailed reviews based on the category, the country (designated or non-designated) where the project is sited, and the environmental impact assessment reports tailored to the industry. The results of the environmental and social impact reviews are sent to the Credit Supervision Department, which carries out comprehensive risk assessments based on the review.

| Category | Definition |

|---|---|

| A | Projects with potential significant adverse environmental and social risks and/or impacts that are diverse, irreversible or unprecedented |

| B | Projects with potential limited adverse environmental and social risks and/or impacts that are few in number, generally site-specific, largely reversible and readily addressed through mitigation measures |

| C | Projects with minimal or no adverse environmental and social risks and/or impacts |

Monitoring Compliance with the Equator Principles

Compliance with important regulations concerning the environment and society is present in our loan agreements, and regular reports on project compliance status confirming whether this has been achieved.

Education and Training

In adopting the Equator Principles in February 2016, multiple training sessions were provided for the employees of sales, assessment, screening and other departments and sections involved to foster a thorough understanding of Equator Principles concepts as well as implementation process for environmental and social risk/impact reviews. Furthermore, regular training sessions are provided for employees in departments and sections relating to sales, assessment, and screening to foster a thorough understanding of internal operations and raise their awareness about environmental and social considerations.

Transactions subject to the Equator Principles

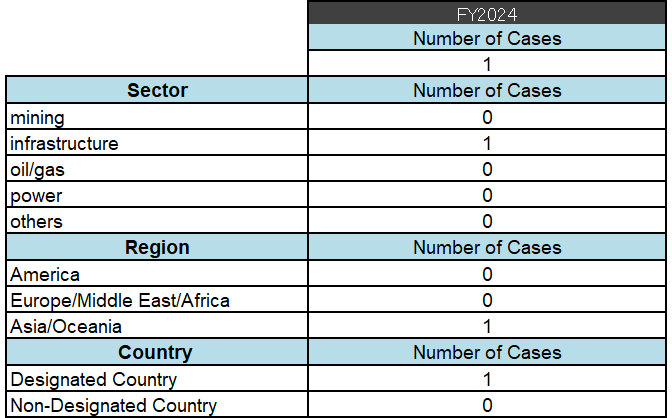

The following data represents the number of Equator Principles applicable Project Finance, Project-Related Corporate Loans and Project-Related Refinance which reached Financial Close in FY 2024 (April 1,2024 to March 31, 2025).

FA services or Project-Related Acquisition Finance applying the Equator Principles in FY2024: None

Project Finance

Project-Related Corporate Loans

Project-Related Refinance